September 2025 Top M&A Deals in Emerging Markets by Region

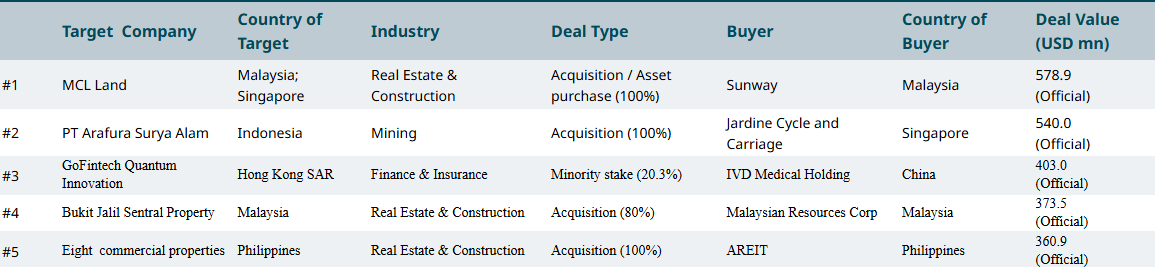

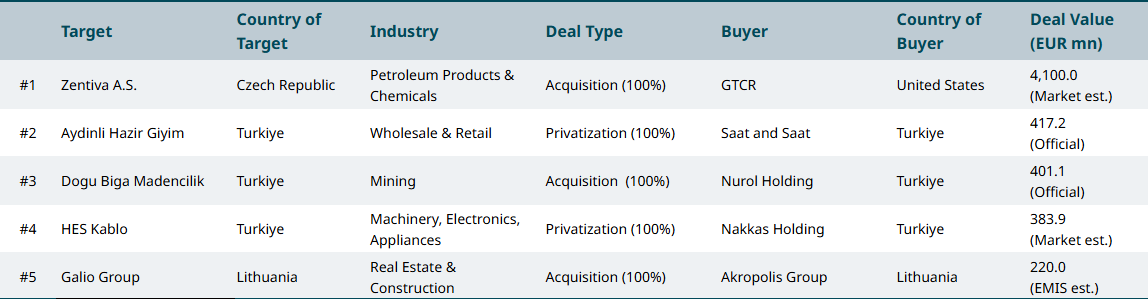

Eastern Europe

U.S. private equity firm GTCR has agreed to acquire Czech generics drugmaker Zentiva from Advent International for EUR 4.1bn, with the deal expected to close in early 2026 pending regulatory approvals. Headquartered in Prague, Zentiva produces affordable medicines for over 100 million people across 30+ countries, with four manufacturing sites and over 5,000 employees. GTCR aims to leverage Zentiva as a strategic platform for growth through bolt-on acquisitions, particularly in consumer health and biosimilars. The firm beat out several global bidders, including India’s Aurobindo Pharma, and plans to scale Zentiva’s market presence in Europe’s fragmented generics sector.

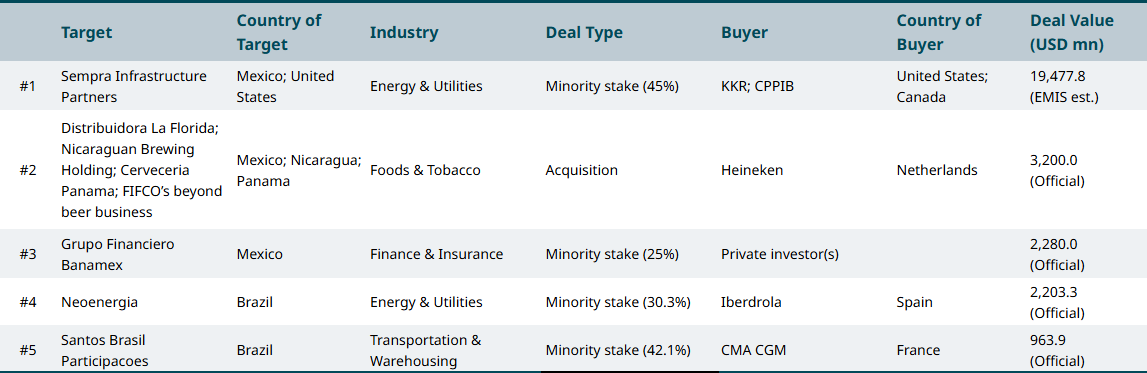

Latin America and the Caribbean

U.S. private equity firm KKR and the Canada Pension Plan Investment Board (CPPIB) have agreed to acquire a 45% stake in Sempra Infrastructure Partners from U.S.-based Sempra for USD 10bn, implying an equity value of USD 22.2bn and an enterprise value of USD 31.7bn. Following the deal, a KKR-led consortium will hold a 65% controlling interest, while Sempra retains 25% and Abu Dhabi Investment Authority (ADIA) holds 10%. The transaction, expected to close in Q2–Q3 2026, enables Sempra to fund its USD 56bn capital plan while focusing on regulated utilities.

Emerging Asia

Hongkong Land has agreed to divest its Singapore and Malaysia-based residential development unit, MCL Land, to Malaysia's Sunway Group for SGD 739mn (USD 579mn). The divestment supports Hongkong Land’s 2035 strategic plan to exit the residential build-to-sell market and focus on ultra-premium commercial properties in Asian gateway cities. Proceeds will strengthen the company’s balance sheet and fund an additional USD 150mn for its ongoing share buyback. The deal is expected to close by end-2025.